Catalogue Search | MBRL

Search Results Heading

Explore the vast range of titles available.

MBRLSearchResults

-

DisciplineDiscipline

-

Is Peer ReviewedIs Peer Reviewed

-

Series TitleSeries Title

-

Reading LevelReading Level

-

YearFrom:-To:

-

More FiltersMore FiltersContent TypeItem TypeIs Full-Text AvailableSubjectCountry Of PublicationPublisherSourceTarget AudienceDonorLanguagePlace of PublicationContributorsLocation

Done

Filters

Reset

139,672

result(s) for

"Auditors"

Sort by:

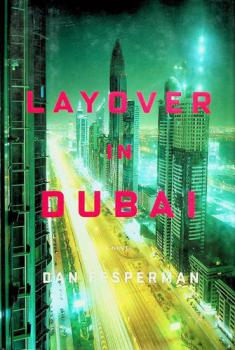

Layover in Dubai

Corporate auditor Sam Keller finds himself surrounded by Dubai's underworld violence in the wake of a colleague's murder and turns for help to unlikely detective Anwar Sharaf, a partnership that tests the dark regions of each man's heart.

Big N Auditors and Audit Quality

by

Wang, Isabel Yanyan

,

Wang, K. Philip

,

Jiang, John (Xuefeng)

in

Accounting firms

,

Acquisition

,

Auditing

2019

Whether Big N auditors provide higher audit quality than non-Big N auditors remains a debate. We add new evidence to this debate by utilizing the setting of Big N auditors' acquisitions of non-Big N auditors. We identify 331 treatment firms that switched to Big N auditors due to the exogenous shocks imposed by Big N acquisitions. Our difference-in-differences analyses show that treatment firms' audit quality improves after switching to Big N auditors. In comparison, mergers or acquisitions among non-Big Ns have little impact on audit quality. Our cross-sectional analyses suggest the audit quality improvement among treatment firms is more likely due to Big N auditors' general competence rather than their industry-specific expertise. Finally, we find that treatment firms experience no significant market reactions around the announcements of Big N acquisitions, indicating that the capital markets may not attach any premium to the improved audit quality associated with Big N auditors.

Journal Article

Layover in Dubai

by

Fesperman, Dan, 1955- author

in

Auditors Fiction

,

Business intelligence Fiction

,

Murder Fiction

2010

Corporate auditor Sam Keller finds himself surrounded by Dubai's underworld violence in the wake of a colleague's murder and turns for help to unlikely detective Anwar Sharaf, a partnership that tests the dark regions of each man's heart.

The Contagion Effect of Low-Quality Audits at the Level of Individual Auditors

2017

This study examines the relation between the audit failures of individual auditors and the quality of other audits performed by these same auditors. Employing a Chinese setting where audit reports reveal the identities of engagement auditors, we find that auditors who have performed failed audits also deliver lower-quality audits on other audit engagements, with this \"contagion\" effect spreading both over time and to other audits performed by these same auditors in the same year. However, we find little evidence that an audit failure also casts doubt on the quality of audits performed by \"non-failed\" auditors who are same-office colleagues of a \"failed\" auditor. We further discover that the contagion effect is attenuated for female auditors, auditors holding a master's degree, and auditors with more auditing experience. Our results underscore the usefulness of disclosing the identity and personal characteristics of individual auditors to investors and regulators.

Journal Article

Do Individual Auditors Affect Audit Quality? Evidence from Archival Data

by

Wu, Donghui

,

Gul, Ferdinand A.

,

Yang, Zhifeng

in

Accounting firms

,

Accounting theory

,

Archives & records

2013

We examine whether and how individual auditors affect audit outcomes using a large set of archival Chinese data. We analyze approximately 800 individual auditors and find that they exhibit significant variation in audit quality. The effects that individual auditors have on audit quality are both economically and statistically significant, and are pronounced in both large and small audit firms. We also find that the individual auditor effects on audit quality can be partially explained by auditor characteristics, such as educational background, Big N audit firm experience, rank in the audit firm, and political affiliation. Our findings highlight the importance of scrutinizing and understanding audit quality at the individual auditor level.

Journal Article

Why are expanded audit reports not informative to investors? Evidence from the United Kingdom

by

Lennox, Clive S

,

Schmidt, Jaime J

,

Thompson, Anne M

in

Abnormal returns

,

Annual reports

,

Audited financial statements

2023

Standard-setters worldwide have passed new audit reporting requirements aimed at making audit reports more informative to investors. In the UK, the new standard expands the audit reporting model by requiring auditors to disclose the risks of material misstatement (RMMs) that had the greatest effect on the financial statement audit. Using short window tests, prior research indicates that these disclosures are not incrementally informative to investors (Gutierrez et al. in Review of Accounting Studies 23:1543–1587, 2018). In this study, we investigate three potential explanations for why investors do not find the additional auditor risk disclosures to be informative. First, using long-window tests, we find no evidence that the insignificant short-window market reactions are due to a delayed investor reaction to RMMs. Second, using value relevance tests, we show that the insignificant market reactions are not due to auditors disclosing irrelevant information. Finally, we provide evidence suggesting that RMMs lack information content because investors were already informed about the financial reporting risks before auditors began disclosing them in expanded audit reports.

Journal Article