Catalogue Search | MBRL

Search Results Heading

Explore the vast range of titles available.

MBRLSearchResults

-

DisciplineDiscipline

-

Is Peer ReviewedIs Peer Reviewed

-

Series TitleSeries Title

-

Reading LevelReading Level

-

YearFrom:-To:

-

More FiltersMore FiltersContent TypeItem TypeIs Full-Text AvailableSubjectCountry Of PublicationPublisherSourceTarget AudienceDonorLanguagePlace of PublicationContributorsLocation

Done

Filters

Reset

115,809

result(s) for

"POLITICAL RISK"

Sort by:

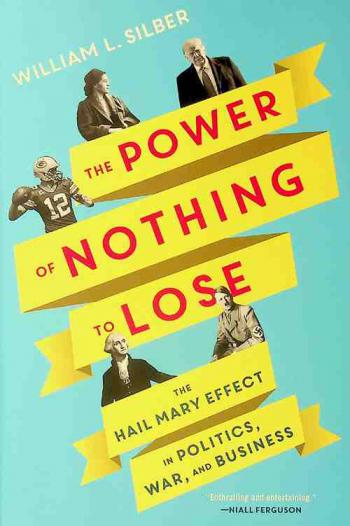

The power of nothing to lose : the Hail Mary effect in politics, war, and business

\"A quarterback like Green Bay's Aaron Rodgers gambles with a Hail Mary pass at the end of a football game when he has nothing to lose - the risky throw might turn defeat into victory, or end in a meaningless interception. Rodgers may not realize it, but he has much in common with figures such as George Washington, Rosa Parks, Woodrow Wilson, and Adolph Hitler, all of whom changed the modern world with their risk-loving decisions. In The Power of Nothing to Lose, award-winning economist William Silber explores the phenomenon in politics, war, and business, where situations with a big upside and limited downside trigger gambling behavior like with a Hail Mary. Silber describes in colorful detail how the American Revolution turned on such a gamble. The famous scene of Washington crossing the Delaware on Christmas night to attack the enemy may not look like a Hail Mary, but it was. Washington said days before his risky decision, \"If this fails I think the game will be pretty well up.\" Rosa Parks remained seated in the White section of an Alabama bus, defying local segregation laws, an act that sparked the modern civil rights movement in America. It was a life-threatening decision for her, but she said, \"I was not frightened. I just made up my mind that as long as we accepted that kind of treatment it would continue, so I had nothing to lose.\" The risky exploits of George Washington and Rosa Parks made the world a better place, but demagogues have also caused significant harm with Hail Marys. Toward the end of World War II, Adolf Hitler ordered a desperate counterattack, the Battle of the Bulge, to stem the Allied advance into Germany. He said, \"The outcome of the battle would spell either life or death for the German nation.\" Hitler failed to change the war's outcome, but his desperate gamble inflicted great collateral damage, including the worst wartime atrocity on American troops in Europe. Silber shares illuminating insights on these figures and more, from Woodrow Wilson to Donald Trump, from asylum seekers to terrorists and rogue traders. Collectively they illustrate that downside protection fosters risky undertakings, that is changes the world in ways we least expect\" -- Book jacket.

Analysing the impact of geopolitical risk and economic policy uncertainty on the environmental sustainability: evidence from BRICS countries

by

Ullah, Irfan

,

Li, Hua

,

Ali, Muhammad Sibt e

in

(Geo)Political Risk

,

Alternative energy sources

,

Aquatic Pollution

2024

This key article seeks to empirically examine the impact of geopolitical risk, economic policy uncertainty (EPU), natural resources, and renewable energy on a country’s ecological footprint, a proxy for environmental sustainability on a national scale. We conducted a quantitative study using the cross-sectional autoregressive distributive lag, augmented mean group, and common correlated effect mean group estimation models, as well as a few tests such as the CD test, Westerlund’s co-integration, and CIPS and CADF unit root tests, beginning in January 2000 and ending in January 2021, to determine the data’s reliability. The findings indicate that while GPR and renewable energy sources lessen the ecological footprint (EF), EPU and the use of non-renewable energy enhance the EF. The study’s scope is narrowed to the BRICS nations, but its implications for expanding existing knowledge and shaping policy are enormous. The results can aid decision-makers in preparing for the possibility of unexpected events causing harm to the economy. The reliability of the evidence can be strengthened by employing more stringent research methods. This study’s dimensions reflect the current research paradigm. The research has policy implications for achieving sustainable development goals in emerging economies.

Journal Article

Political risk spreads

by

Lundblad, Christian T

,

Harvey, Campbell R

,

Siegel, Stephan

in

American dollar

,

Bond markets

,

Business and Management

2014

We introduce a new, market-based and forward-looking measure of political risk derived from the yield spread between a country's US dollar debt and an equivalent US Treasury bond. We explain the variation in these sovereign spreads with four factors: global economic conditions, country-specific economic factors, liquidity of the country's bond, and political risk. We then extract the part of the sovereign spread that is due to political risk, making use of political risk ratings. In addition, we provide new evidence that these political risk ratings are predictive, on average, of future risk realizations using data on political risk claims as well as a novel textual-based database of risk realizations. Our political risk spread measure does not make the mistake of double counting systematic risk in the evaluation of international investments, as some conventional measures do. Furthermore, we show how to construct political risk spreads for countries that do not have sovereign bond data. Finally, we link our political risk spreads to foreign direct investment (FDI). We show that a 1% point reduction in the political risk spreads is associated with a 12% increase in netinflows of FDI.

Journal Article

Firm-specific political risk: a systematic investigation of its antecedents and implications for vertical integration and diversification strategies

2023

PurposeUncertainties caused by political risks can drastically affect global supply chains. However, the supply chain management literature has thus far developed rather limited knowledge on firms' perception of and reactions to increased political risks. This study has two main purposes: to explore the relationship between extant risk exposure and perceived firm-specific political risk and to understand the impact of firm-specific political risk on firms' vertical integration and diversification strategies.Design/methodology/approachThe authors developed a unique dataset for testing our hypotheses. Specifically, the authors sampled manufacturers (SIC20-39) listed in the United States from 2002 to 2019. The authors collected financial and diversification data from Compustat, vertical integration data from the Frésard-Hoberg-Phillips Vertical Relatedness Data Library and political risk data from the Economic Policy Uncertainty database. This data collection process yielded 1,287 firms (8,329 observations) with available data for analysis.FindingsA two-way fixed-effect regression analysis of panel data revealed that firms tend to be more sensitive to political risk when faced with income stream uncertainty or strategic risk. By contrast, exposure to stock returns uncertainty does not significantly influence firms' sensitivity toward political risk. Moreover, firm-specific political risk is positively associated with vertical integration and product diversification. However, firm-specific political risk does not result in higher levels of geographical diversification.Originality/valueThis study joins the literature that systematically explores the antecedents and implications of firm-specific political risk, thus broadening the scope of supply chain risk management.

Journal Article

Political risk : how businesses and organizations can anticipate global insecurity

\"[This book] investigates and analyzes this evolving landscape, what businesses can do to navigate it, and what all of us can learn about how to better understand and grapple with these rapidly changing global political dynamics\"--Amazon.com.

Political Risk, Democratic Institutions, and Foreign Direct Investment

2008

There is a renewed interest in how political risk affects multinational corporations operating in emerging markets. Much of this research has focused on the relationship between democratic institutions and flows of foreign direct investment (FDI). Yet the existing studies suffer from data problems that only allow for indirect evidence of the relationship between political institutions and political risk. In this paper I utilize price data from political risk insurance agencies to directly test how domestic political institutions affect the premiums multinationals pay for coverage against government expropriations and contract disputes. I find that democratic regimes reduce risks for multinational investors, specifically through increasing constraints on the executive. Utilizing qualitative evidence from investors, insurers, and location consultants, I explore the mechanisms linking democratic regimes with lower levels of political risk.

Journal Article

Does firm-level political risk affect cash holdings?

by

Alam, Md Samsul

,

Paramati, Sudharshan Reddy

,

Islam, Md Shahidul

in

Cash management

,

Companies

,

Constraints

2022

We investigate whether firm-level political risk affects corporate cash holdings. Taking a sample of 5424 US firms with 129,750 firm-quarter observations from 2002Q1 to 2021Q3, we find that cash holdings is higher for firms with greater exposure to firm-level political risk. The positive relationship between firm political risk and cash holdings is consistent for financial constraint and non-constraint firms, high and low growth firms, pro-cyclical and counter-cyclical and competitive industries. Further, our findings are consistent to alternative measures of firm-level political risk and cash holdings. In addition, our findings remain robust with different endogeneity tests: a natural experiment, an instrumental variable approach, and a propensity score matching. Overall, we present novel evidence on the determinants of corporate cash holdings.

Journal Article