Catalogue Search | MBRL

Search Results Heading

Explore the vast range of titles available.

MBRLSearchResults

-

DisciplineDiscipline

-

Is Peer ReviewedIs Peer Reviewed

-

Series TitleSeries Title

-

Reading LevelReading Level

-

YearFrom:-To:

-

More FiltersMore FiltersContent TypeItem TypeIs Full-Text AvailableSubjectCountry Of PublicationPublisherSourceTarget AudienceDonorLanguagePlace of PublicationContributorsLocation

Done

Filters

Reset

51

result(s) for

"Rickards, James"

Sort by:

When Is a Polynomial a Composition of Other Polynomials?

2011

In this note we explore when a polynomialf(x) can be expressed as a composition of other polynomials. First, we give a necessary and sufficient condition on the roots off(x). Through a clever use of symmetric functions we then show how to determine iff(x) is expressible as a composition of polynomials without needing to know any of the roots off(x).

Journal Article

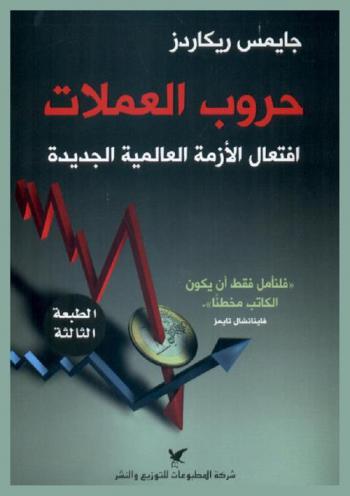

حروب العملات : افتعال الأزمة العالمية الجديدة

by

Rickards, James مؤلف

,

Rickards, James

,

باسيل، أنطوان مترجم

in

النقود جوانب اقتصادية

,

النقود جوانب سياسية

,

السياسة الاقتصادية

2014

نوع آخر من الحروب، بعد الحرب الباردة وحروب الشرق الأوسط. يتحول إلى صراع حقيقي بين الدول العظمى، صراع بلا دوي مدافع وقصف طائرات، يحدث خلسة وخفية وعبر مكائد اقتصادية، ويفضي إلى كوارث مالية تعزز واقعا سياسيا جديدا ونظما غير التي كانت قائمة. فقط يتغير القادة، من عسكريين أشداء إلى اقتصاديين محنكين، دارسين، متابعين. إنها حرب العملات، في كتاب : يضع اليد على هذه الحرب، الأسهل وسائل والأشد فتكا بالمجتمعات من الداخل. يقدم أزمة العام 2008 المالية، يحلل أسباب حدوثها، وكيف حاول الخبراء تفاديها بداية، ومحاولات تفاديها التي باءت بالفشل والتي كادت تفضي إلى مخاطر أكبر. يستعرض مفاعيل حرب العملات، من انهيار للأوراق المالية وتجميد للأصول، ومصادرة للذهب وفرض للرقابة على رؤوس الأموال. فضلا عن التلاعب بعملات الدول. يحذر من مغبة حرب العملات، وتأثيرها البالغ في البلدان ذات الأسواق الناشئة، بحيث ترفع قيمة عملتها الوطنية، وبالتالي قيمة صادراتها وتصبح أكثر عرضة للخسارة وأقل قدرة على النمو.

A new risk management model for Wall Street

2009

Financial economics, over the past 50 years, has specialized in quantitative analysis of the problems of asset pricing, asset allocation, and risk management. Its contributions have been voluminous, leading to the creation of derivative products and enormous expansion of the markets in which those products are traded. Key contributions have included the Black-Scholes options pricing formula and the capital asset pricing model. Of course, many critics, notably Nassim Nicolas Taleb in his book The Black Swan: The Impact of the Highly Improbable, have argued that analytics based on normal distributions do not accurately describe market behavior in many instances. In summary, Wall Street's reigning risk management paradigm is a manifest failure. It uses a combination of stochastic methods in a normally distributed model combined with \"stress testing\" to account for outliers. It should be replaced with the empirically robust model based on nonlinear complexity and critical-state dynamics.

Journal Article

Intersections of Closed Geodesics on Shimura Curves

2021

Let G be a discrete subgroup of PSL(2, R), and consider closed geodesics on the quotient of the upper half plane by G. In this thesis, we study how these geodesics intersect when G is the group of units of norm 1 in an Eichler order of an indefinite quaternion algebra over Q, i.e. over a Shimura curve. We start by developing some theory for a general G, providing a pathway to interpret the geometry of the situation (intersection point, angle, etc.) in terms of the algebra of G. The next focus is on G=PSL(2, Z), where we relate the work to Conway's topograph, as well as work by Duke, Imamoglu, and Toth on the linking number of modular knots. We then detail some background on quaternion algebras, before diving in to the Shimura curve case. We re-interpret intersection numbers in terms of x-linking of optimal embeddings of real quadratic orders, and produce formulas which count the total amount of x-linking in a given Eichler order. These formulas are essentially a real quadratic analogue to classical results of Gross and Zagier. We define Hecke operators acting on optimal embeddings, and using the signed intersection pairing, produce formal q-series, which are proven to be weight two modular forms on Gamma_0(N). The thesis is concluded with a conjectural relation to work of Darmon and Vonk on a real quadratic analogue to the difference of j-values, a brief description of the practical algorithms used to compute with intersection numbers, and a short survey of future projects

Dissertation

The road to ruin : the global elites' secret plan for the next financial crisis

\"Rickards [argues that] ... governments around the world have no compunction about conspiring against their citizens. They will have stockpiled hard assets when stock exchanges are closed, ATMs shut down, money market funds frozen, asset managers instructed not to sell securities, negative interest rates imposed, and cash withdrawals denied. If you [believe in] the risks ahead, you [may need] Rickards's ... synthesis of behavioral economics, history, and complexity theory\"-- Provided by publisher.

When Is a Polynomial a Composition of Other Polynomials?

2011

In this note we explore when a polynomial f(x) can be expressed as a composition of other polynomials. First, we give a necessary and sufficient condition on the roots of f(x). Through a clever use of symmetric functions we then show how to determine if f(x) is expressible as a composition of polynomials without needing to know any of the roots of f(x). [PUBLICATION ABSTRACT]

Journal Article