Catalogue Search | MBRL

Search Results Heading

Explore the vast range of titles available.

MBRLSearchResults

-

DisciplineDiscipline

-

Is Peer ReviewedIs Peer Reviewed

-

Series TitleSeries Title

-

Reading LevelReading Level

-

YearFrom:-To:

-

More FiltersMore FiltersContent TypeItem TypeIs Full-Text AvailableSubjectCountry Of PublicationPublisherSourceTarget AudienceDonorLanguagePlace of PublicationContributorsLocation

Done

Filters

Reset

164

result(s) for

"Sotheby "

Sort by:

Catalogue of important Oriental manuscripts and miniatures : the property of the Hagop Kevorkian Fund : which will be sold by auction by Sotheby Parke Bernet & Co. at their large galleries, 34 & 35 New Bond Street, London W1A 2AA ; day of sale : Monday, 23rd April, 1979

by

Sotheby Parke Bernet & Co. author

in

Hagop Kevorkian Fund Art collections Catalogs.

,

Manuscripts, Oriental Private collections Catalogs.

,

Miniature painting, Oriental Private collections Catalogs.

1979

Reference book

A CLARIFICATION ON FERC'S DISCRETION IN FINDING JUST AND REASONABLE RATES IN THE ELECTRICITY MARKET: PUBLIC CITIZEN, INC. V. FERC

Conclusion.138 I. Introduction In Public Citizen, Inc. v. FERC (Public Citizen), the United States Court of Appeals for the D.C. Circuit unanimously held that the Federal Energy Regulatory Commission (FERC or Commission) decision to uphold Midcontinent Independent System Operator's (MISO) 2015 Electricity Capacity Auction results was arbitrary and capricious.1 The auction resulted in prices for a regional zone, covering most of Illinois, forty times higher than neighboring zones.2 This price anomaly ultimately led to several parties filing complaints at FERC under section 206 of the Federal Power Act (FPA).3 FERC agreed that the auction rules were producing unreasonable price spikes and ordered prospective changes as well as a separate investigation into possible market manipulation.4 But it declined to call into question the 2015 auction results themselves and also closed its investigation without bringing an enforcement action against any market participants.5 It was the FERC's denial of relief with respect to the 2015 auction results and its decision to close the investigation that prompted the complainants' appeal.6 The Court ultimately remanded the case to FERC to provide an explanation for determining that the 2015 Auction results were just and reasonable, rejecting FERC's \"breezy\" analysis on this question as arbitrary and capricious.7 But the Court also held that it could not review FERC's separate decision to close its market manipulation investigation.8 Further, and most crucially, the Court held that under section 205 of the FPA FERC is not required to review individual electricity prices for justness and reasonableness before they go into effect where those prices were set as part of an auction whose market-based methodology FERC approved as just and reasonable and where FERC is conducting continual oversight of the functioning of a market-based tariff.9 This case note will first discuss the relevant background surrounding the history of the FPA and FERC's administration of the FPA, the just and reasonable electricity rate requirement, and the prohibition of market manipulation within the electricity industry. [...]this note will provide the procedural history of the relevant FERC Orders, an analysis of each of the D.C. Circuit's holdings, and an analysis of whether the Court was correct in not requiring the Commission to approve each individual market-based price for electricity capacity when it had already approved the underlying market-based rate setting methodology producing those prices as just and reasonable. \"16 Accordingly, FERC does not have jurisdiction over intrastate transmission and sales of electric energy, which is instead left to individual States to regulate.17 Congress amended the FPA by passing the Energy Policy Act of 2005 (EPAct), which expanded the FERC's responsibilities to include the authority to \"issue rules to bar market manipulation\" and the authority to impose civil penalties to entities that participate in the market manipulation.18 As seen in subsequent FERC decisions, the Commission has used this expanded authority to regulate market manipulation in the wholesale electricity market in particular.19 B.The Just and Reasonable Electricity Rate Requirement FERC's authority over electricity rates in interstate commerce is set forth in sections 205 and 206 of the FPA, which not only mandate that prices charged for electricity rates are \"just and reasonable,\" but also set forth filing requirements for public utilities and provide the Commission with the power to review rates charged for electricity.20 Section 205 of the FPA concerns new or prospective electric rates and requires that \"[a]ll rates and charges . . . for or in connection with the transmission or sale of electric energy . . . and all rules and regulations\" relating to those rates or charges be \"just and reasonable. \"28 Section 206 places the burden of proof on the filing party, which could be the Commission or third-party complainant.29 If FERC determines existing rates are unjust and unreasonable, FERC must proscribe its own \"just and reasonable\" rates.30 C.The Prohibition on Market Manipulation Within the Electricity Industry Market manipulation within the energy market not only \"render[s] prices and price-setting mechanism inaccurate and unreliable . . . \" but diminishes the overall confidence in the market's ability to produce just and reasonable rates.31 Market manipulation ultimately causes harm to both market participants and energy consumers through interfering with functioning of free markets and driving up electricity prices to end users.32 The danger of market manipulation was illustrated by the Western Energy Crisis, which was the event that ultimately motivated Congress to provide FERC with authority to combat market manipulation.33 After the events of the Western Energy Crisis, Congress amended the FPA through the EPAct of 2005.34 Congress passed the amendment to provide the Commission enforcement tools to prohibit market manipulation and authority to enforce civil penalties, the lack of which had previously provided less accountability for utilities and did not \"effectively deter and sanction market manipulation.

Journal Article

Catalogue of fine Oriental manuscripts : the property of the Hagop Kevorkian Fund ... : which will be sold by auction by Sotheby Parke Bernet & Co. ... at their Kiddell Gallery, 34 & 35 New Bond Street, London W1A 2AA ... ; day of sale : Monday, 26th April, 1982

by

Sotheby Parke Bernet & Co. author

in

Manuscripts, Oriental Catalogs.

,

Manuscripts, Persian Catalogs.

,

Islamic bookbinding Catalogs

1982

Reference book

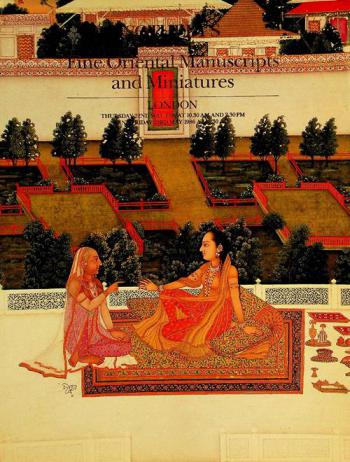

Catalogue of fine Oriental miniatures, manuscripts and Qajar paintings : day of sale, Tuesday, 4th April, 1978

by

Sotheby Parke Bernet & Co. author

in

Manuscripts, Oriental Catalogs.

,

Islamic illumination of books and manuscripts Catalogs.

,

Illumination of books and manuscripts Asia Catalogs

1978

Reference book