Catalogue Search | MBRL

Search Results Heading

Explore the vast range of titles available.

MBRLSearchResults

-

DisciplineDiscipline

-

Is Peer ReviewedIs Peer Reviewed

-

Series TitleSeries Title

-

Reading LevelReading Level

-

YearFrom:-To:

-

More FiltersMore FiltersContent TypeItem TypeIs Full-Text AvailableSubjectCountry Of PublicationPublisherSourceTarget AudienceDonorLanguagePlace of PublicationContributorsLocation

Done

Filters

Reset

173

result(s) for

"2001-2010"

Sort by:

THE EMPLOYMENT EFFECTS OF CREDIT MARKET DISRUPTIONS

2014

This article investigates the effect of bank lending frictions on employment outcomes. I construct a new data set that combines information on banking relationships and employment at 2,000 nonfinancial firms during the 2008–9 crisis. The article first verifies empirically the importance of banking relationships, which imply a cost to borrowers who switch lenders. I then use the dispersion in lender health following the Lehman crisis as a source of exogenous variation in the availability of credit to borrowers. I find that credit matters. Firms that had precrisis relationships with less healthy lenders had a lower likelihood of obtaining a loan following the Lehman bankruptcy, paid a higher interest rate if they did borrow, and reduced employment by more compared to precrisis clients of healthier lenders. Consistent with frictions deriving from asymmetric information, the effects vary by firm type. Lender health has an economically and statistically significant effect on employment at small and medium firms, but the data cannot reject the hypothesis of no effect at the largest or most transparent firms. Abstracting from general equilibrium effects, I find that the withdrawal of credit accounts for between one-third and one-half of the employment decline at small and medium firms in the sample in the year following the Lehman bankruptcy.

Journal Article

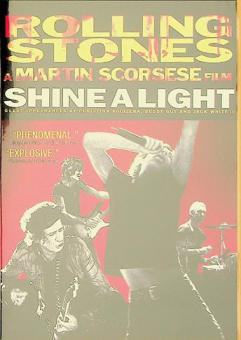

Shine a light

by

Scorsese, Martin film director

,

Cohl, Michael film producer

,

Weiner, Zane film producer

in

Rolling Stones drama

,

Rock music 2001-2010 Drama

2000

A career-spanning documentary on the Rolling Stones, with concert footage from their \"A Bigger Bang\" tour.

Women on Boards in Finance and STEM Industries

2016

We document that women are less represented on corporate boards in Finance and more traditional STEM industry sectors. Even after controlling for differences in firm and country characteristics, average diversity in these sectors is 24% lower than the mean. Our findings suggest that well-documented gender differences in STEM university enrolments and occupations have long-term consequences for female business leadership. The leadership gap in Finance and STEM may be difficult to eliminate using blanket boardroom diversity policies. Diversity policies are also likely to have a different impact on firms in these sectors than in non-STEM sectors.

Journal Article

DOES ENFORCEMENT OF INTELLECTUAL PROPERTY RIGHTS MATTER IN CHINA? EVIDENCE FROM FINANCING AND INVESTMENT CHOICES IN THE HIGH-TECH INDUSTRY

2014

Using a unique and rich database of high-technology firms in China, we show that effective enforcement of intellectual property rights at the provincial level is critical in encouraging financing and investing in R& D. Better enforcement of intellectual property (IP) rights positively affects firms' ability to acquire new external debt and allows firms to invest in more R&D, generate more innovation patents, and produce more sales from new products. Our results suggest that facilitating financing and investing in R&D are the channels through which better IP rights enforcement can affect economic growth.

Journal Article

Playing changes : jazz for the new century

One of jazz's leading critics gives us an invigorating, richly detailed portrait of the artists and events that have shaped the music of our time. Grounded in authority and brimming with style, Playing Changes is the first book to take the measure of this exhilarating moment: it is a compelling argument for the resiliency of the art form and a rejoinder to any claims about its calcification or demise. \"Playing changes,\" in jazz parlance, has long referred to an improvisers resourceful path through a chord progression. Playing Changes boldly expands on the idea, highlighting a host of significant changes: ideological, technological, theoretical, and practical that jazz musicians have learned to navigate since the turn of the century. Nate Chinen, who has chronicled this evolution firsthand throughout his journalistic career, vividly sets the backdrop, charting the origins of jazz historicism and the rise of an institutional framework for the music. He traces the influence of commercialized jazz education and reflects on the implications of a globalized jazz ecology. He unpacks the synergies between jazz and postmillennial hip-hop and R&B, illuminating an emergent rhythm signature for the music. And he shows how a new generation of shape-shifting elders, including Wayne Shorter and Henry Threadgill, have moved the aesthetic center of the music. Woven throughout the book is a vibrant cast of characters from the saxophonists Steve Coleman and Kamasi Washington to the pianists Jason Moran and Vijay Iyer to the bassist and singer Esperanza Spaldingwho have exerted an important influence on the scene. This is an adaptive new music for a complex new reality, and Playing Changes is the definitive guide.

Do Director Elections Matter?

by

Li, Kai

,

Tsoutsoura, Margarita

,

Fos, Vyacheslav

in

2001-2010

,

Corporate governance

,

Elections

2018

Using a hand-collected sample of election nominations for more than 30,000 directors over the period 2001–2010, we construct a novel measure of director proximity to elections called Years-to-election. We find that the closer directors of a board are to their next elections, the higher CEO turnover-performance sensitivity is. A series of tests, including one that exploits variation in Years-to-election that comes from other boards, supports a causal interpretation. Further analyses show that other governance mechanisms do not drive the relation between board Years-to-election and CEO turnover-performance sensitivity. We conclude that director elections have important implications for corporate governance.

Journal Article

The Cross-Section of Credit Risk Premia and Equity Returns

by

FRIEWALD, NILS

,

ZECHNER, JOSEF

,

WAGNER, CHRISTIAN

in

2001-2010

,

Capital asset pricing models

,

Compensation

2014

We explore the link between a firm's stock returns and credit risk using a simple insight from structural models following Merton (1974): risk premia on equity and credit instruments are related because all claims on assets must earn the same compensation per unit of risk. Consistent with theory, we find that firms' stock returns increase with credit risk premia estimated from CDS spreads. Credit risk premia contain information not captured by physical or risk-neutral default probabilities alone. This sheds new light on the \"distress puzzle\"—the lack of a positive relation between equity returns and default probabilities—reported in previous studies.

Journal Article