Catalogue Search | MBRL

Search Results Heading

Explore the vast range of titles available.

MBRLSearchResults

-

DisciplineDiscipline

-

Is Peer ReviewedIs Peer Reviewed

-

Series TitleSeries Title

-

Reading LevelReading Level

-

YearFrom:-To:

-

More FiltersMore FiltersContent TypeItem TypeIs Full-Text AvailableSubjectCountry Of PublicationPublisherSourceTarget AudienceDonorLanguagePlace of PublicationContributorsLocation

Done

Filters

Reset

3,644,533

result(s) for

"INTERESTS"

Sort by:

Ultimate aptitude tests : over 1000 practice questions for abstract visual, numerical, verbal, physical, spatial and systems tests

by

Barrett, James, author

,

Barrett, Tom, author

in

Occupational aptitude tests.

,

Vocational interests Testing.

,

Ability Testing.

2018

\"Do you need to prepare for an aptitude test for an interview or selection process? Do you want to practise and improve your scores? Ultimate Aptitude Tests, now in its fourth edition and part of the best-selling Ultimate series, is the largest and most comprehensive book of its kind, boasting over 1000 varied practice aptitude questions with accompanying answers and explanations. In such a competitive job market, it's the perfect book to ensure you're entirely prepared to get those high scores and impress potential employers.\"--Publisher description.

The unheavenly chorus

2012,2013

Politically active individuals and organizations make huge investments of time, energy, and money to influence everything from election outcomes to congressional subcommittee hearings to local school politics, while other groups and individual citizens seem woefully underrepresented in our political system.The Unheavenly Chorusis the most comprehensive and systematic examination of political voice in America ever undertaken--and its findings are sobering.

The Unheavenly Chorusis the first book to look at the political participation of individual citizens alongside the political advocacy of thousands of organized interests--membership associations such as unions, professional associations, trade associations, and citizens groups, as well as organizations like corporations, hospitals, and universities. Drawing on numerous in-depth surveys of members of the public as well as the largest database of interest organizations ever created--representing more than thirty-five thousand organizations over a twenty-five-year period--this book conclusively demonstrates that American democracy is marred by deeply ingrained and persistent class-based political inequality. The well educated and affluent are active in many ways to make their voices heard, while the less advantaged are not. This book reveals how the political voices of organized interests are even less representative than those of individuals, how political advantage is handed down across generations, how recruitment to political activity perpetuates and exaggerates existing biases, how political voice on the Internet replicates these inequalities--and more.

In a true democracy, the preferences and needs of all citizens deserve equal consideration. Yet equal consideration is only possible with equal citizen voice.The Unheavenly Chorusreveals how far we really are from the democratic ideal and how hard it would be to attain it.

Banking on Deposits: Maturity Transformation without Interest Rate Risk

2021

We show that maturity transformation does not expose banks to interest rate risk—it hedges it. The reason is the deposit franchise, which allows banks to pay deposit rates that are low and insensitive to market interest rates. Hedging the deposit franchise requires banks to earn income that is also insensitive, that is, to lend long term at fixed rates. As predicted by this theory, we show that banks closely match the interest rate sensitivities of their interest income and expense, and that this insulates their equity from interest rate shocks. Our results explain why banks supply long-term credit.

Journal Article

Deviations from Covered Interest Rate Parity

2018

We find that deviations from the covered interest rate parity (CIP) condition imply large, persistent, and systematic arbitrage opportunities in one of the largest asset markets in the world. Contrary to the common view, these deviations for major currencies are not explained away by credit risk or transaction costs. They are particularly strong for forward contracts that appear on banks' balance sheets at the end of the quarter, pointing to a causal effect of banking regulation on asset prices. The CIP deviations also appear significantly correlated with other fixed income spreads and with nominal interest rates.

Journal Article

A global history of trade and conflict since 1500

\"This volume is a major historical contribution to the enduring debate about whether trade makes peace more likely. In nine detailed historical case studies - spread over 500 years and spanning the globe - the contributors explore the dynamic between trade and conflict and examine the consequences of their intersection, direct and indirect, immediate and long term, anticipated and unexpected, transformative and destructive. The contributors break new ground by collectively showing that trade and conflict have been reciprocally constitutive: trade sparks conflict and conflict in turn provokes the adaptation of trade. Scholars who affirm a close association between trade and peace will have to take into account the close and persistent connection between trade and conflict, as will the makers of current trade policy\"-- Provided by publisher.

Interest Rates under Falling Stars

2020

Macro-finance theory implies that trend inflation and the equilibrium real interest rate are fundamental determinants of the yield curve. However, empirical models of the term structure of interest rates generally assume that these fundamentals are constant. We show that accounting for time variation in these underlying long-run trends is crucial for understanding the dynamics of Treasury yields and predicting excess bond returns. We introduce a new arbitrage-free model that captures the key role that long-run trends play in determining interest rates. The model also provides new, more plausible estimates of the term premium and accurate out-of-sample yield forecasts.

Journal Article

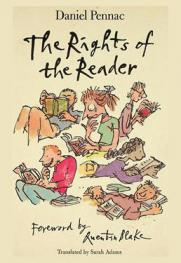

The rights of the reader

by

Pennac, Daniel author

,

Pennac, Daniel Comme un roman

,

Adams, Sarah translator

in

Reading Juvenile literature

,

Reading promotion.

,

Reading interests.

2006

Discusses the power of the story and how we learn to read.

Exchange Rates, Interest Rates, and the Risk Premium

2016

The uncovered interest parity puzzle concerns the empirical regularity that high interest rate countries tend to have high expected returns on short term deposits. A separate puzzle is that high real interest rate countries tend to have currencies that are stronger than can be accounted for by the path of expected real interest differentials under uncovered interest parity. These two findings have apparently contradictory implications for the relationship of the foreign-exchange risk premium and interest-rate differentials. We document these puzzles, and show that existing models appear unable to account for both. A model that might reconcile the findings is discussed.

Journal Article