Asset Details

MbrlCatalogueTitleDetail

Do you wish to reserve the book?

The efect of size on the relationship between control structure and voluntary disclosure in Brazilian companies

by

Bernardi Sonza, Igor

, Naysinger Machado, Vagner

in

Assimetria informacional

/ Control structure

/ Disclosure voluntário

/ Estrutura de controle

/ Informational Asymmetry

/ Voluntary Disclosure

2019

Hey, we have placed the reservation for you!

By the way, why not check out events that you can attend while you pick your title.

You are currently in the queue to collect this book. You will be notified once it is your turn to collect the book.

Oops! Something went wrong.

Looks like we were not able to place the reservation. Kindly try again later.

Are you sure you want to remove the book from the shelf?

The efect of size on the relationship between control structure and voluntary disclosure in Brazilian companies

by

Bernardi Sonza, Igor

, Naysinger Machado, Vagner

in

Assimetria informacional

/ Control structure

/ Disclosure voluntário

/ Estrutura de controle

/ Informational Asymmetry

/ Voluntary Disclosure

2019

Oops! Something went wrong.

While trying to remove the title from your shelf something went wrong :( Kindly try again later!

Do you wish to request the book?

The efect of size on the relationship between control structure and voluntary disclosure in Brazilian companies

by

Bernardi Sonza, Igor

, Naysinger Machado, Vagner

in

Assimetria informacional

/ Control structure

/ Disclosure voluntário

/ Estrutura de controle

/ Informational Asymmetry

/ Voluntary Disclosure

2019

Please be aware that the book you have requested cannot be checked out. If you would like to checkout this book, you can reserve another copy

We have requested the book for you!

Your request is successful and it will be processed during the Library working hours. Please check the status of your request in My Requests.

Oops! Something went wrong.

Looks like we were not able to place your request. Kindly try again later.

The efect of size on the relationship between control structure and voluntary disclosure in Brazilian companies

Journal Article

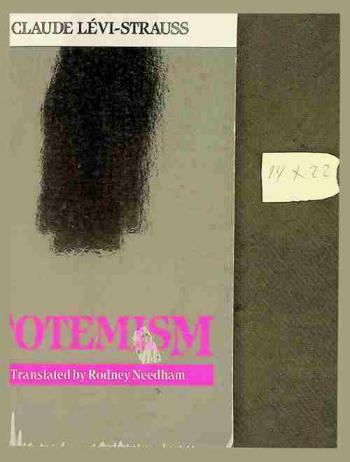

The efect of size on the relationship between control structure and voluntary disclosure in Brazilian companies

2019

Request Book From Autostore

and Choose the Collection Method

Overview

This study aims to analyze the influence of size on the relationship between the control structure on the voluntary disclosure policy of the listed companies in B3. To achieve this goal, we created a dependent variable, called \"voluntary disclosure level\", which corresponds to 38 indicators of information collected manually from the companies' statements and websites. Afterwards, we estimated a balanced panel data regression model with a threshold effect for size in order to identify the relationship between the variables. The results indicated that smaller companies, with a more concentrated control structure, tended to present a higher level of voluntary disclosure. However, for larger companies, the greater the concentration of the control structure, the less evidence of this information. These inferences lead to believe that the largest Brazilian corporations, with more concentrated control, may not be interested in disclosing voluntary information because most of their shareholders enjoy private control benefits.

O estudo objetiva analisar a influência do tamanho na relação entre estrutura de controle e disclosure voluntário das companhias listas na B3. Para atingir este fim, foi criada uma variável dependente, “nível de disclosure voluntário”, que corresponde a 38 indicadores de informações coletados manualmente dos demonstrativos e sites das empresas. Após, estimou-se um modelo de regressão com dados em painel balanceados através do efeito threshold para tamanho, a fim de identificar a relação entre as variáveis. Os resultados indicaram que as empresas menores, com estrutura de controle mais concentrada, tendem a apresentar maior nível de disclosure voluntário. Contudo, para as maiores empresas, quanto maior a concentração da estrutura de controle, menor a evidenciação dessas informações. Essas inferências levam a crer que as maiores corporações brasileiras com controle mais concentrado podem não estar interessadas em divulgar informações voluntárias, porque a maioria de seus acionistas goza de benefícios privados de controle.

This website uses cookies to ensure you get the best experience on our website.